Job Costing for Construction

Estimated reading time: 7 minutes

Joe* runs a growing general contracting business in Tulsa. He’s built a strong crew, has a full project calendar, and clients keep referring more work. But despite the busy schedule, Joe couldn’t figure out why his profit margins were shrinking.

Then came the Henderson remodel. A home addition that should have been a big win turned into a money pit. Change orders went untracked, subcontractors worked extra hours, and the material costs ran over. That was Joe’s wake-up call: “If I’m not tracking each project’s true cost, I’m guessing at my margins.” And so began Joe’s journey into job costing.

What is Job Costing? And Why Should Contractors Care?

In plain terms, job costing is the process of tracking all expenses and revenue associated with a specific job. That means logging materials, labor, equipment, subcontractors, and overhead—and comparing those against what you invoiced the customer.

Job Costing vs. Process Costing: What’s the Difference?

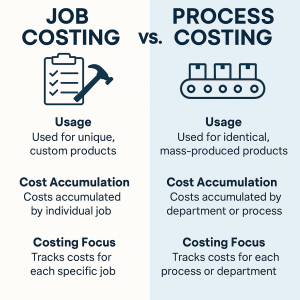

In the world of accounting, there are two primary ways to track project expenses:

- Job Costing is used when work is custom and project-specific—like homebuilding, renovations, or commercial construction. Each project is treated uniquely, with its own cost center.

- Process Costing is better suited for manufacturing or standardized operations—like producing prefabricated panels in a factory. Costs are averaged over identical units or batches.

For most construction businesses, job costing is the gold standard. It helps you track costs on a per-project basis, spot overages early, and improve bidding accuracy.

A Little History

Before digital tools, contractors tracked project costs using physical job folders and ledgers. Each project had an ID, and all timecards, receipts, and invoices were manually tagged to it. Now, modern construction accounting platforms automate the tagging, tracking, and reporting. But the core principle hasn’t changed: link every dollar to a job.

Key Vocabulary

- COGS (Cost of Goods Sold): Direct costs like labor, materials, and subcontractors

- Overhead: Indirect costs like insurance, rent, and office admin

- Estimate vs. Actual: What you budgeted vs. what you actually spent

- Gross Profit: Revenue minus COGS

The Top 3 Benefits of Accurate Job Costing

1. Know Your Real Profitability

Job costing shows which jobs are profitable and which ones are dragging down your margins. It also highlights which crews or subcontractors deliver the most value.

2. Improve Estimating and Bidding

By comparing past estimates to actual costs, you can refine your bidding process. You’ll learn where you typically underbid—whether it’s excavation labor or finish carpentry—and adjust your pricing accordingly.

3. Make Informed Business Decisions

Gain real-time visibility into each project’s financial health. This lets you adjust schedules, manage crews, or update clients when issues arise—before the project goes off the rails.

Prepping Your Construction Business for Job Costing

Getting started with job costing means laying the right groundwork. Here’s how:

- Set Up a Detailed Chart of Accounts

Work with your accountant to break out materials, labor, subcontractors, permits, and equipment into separate categories. The more granular your accounts, the better your insights.

- Establish Inventory and Equipment Tracking

Know what tools, materials, and equipment are used—and on which jobs. Track rental costs, depreciation, and job-specific usage.

- Use a Standardized Job Naming/Numbering System

Every project should have a unique and consistent identifier, like [ClientName]-[ProjectType]-[StartDate]. This makes it easy to search reports and group related data.

- Define What Counts as a Job Cost

Include all direct costs—labor, materials, subcontractors, equipment, permits, and job-specific travel. Exclude fixed company-wide costs unless they’re prorated per job.

- Train Your Field and Office Teams

Everyone must understand the importance of coding time, expenses, and materials correctly. Hold training sessions and provide written guides.

- Implement Construction-Specific Software

Use platforms that integrate estimating, scheduling, accounting, and field tracking. Look for solutions tailored to construction workflows.

Setting Up Job Costing

Follow this step-by-step process to integrate job costing into your operations:

Step 1: Build Detailed Estimates

Start with itemized estimates. Break down labor by phase (e.g., framing, drywall, finish), materials by area (e.g., kitchen, bathroom), and include subcontractor quotes. Attach markup, contingency, and overhead.

Step 2: Assign a Unique Project ID

Use this ID throughout the lifecycle of the project—from purchase orders to timecards. Your software should automate the connection between all financial activity and the job ID.

Step 3: Track Labor Time Per Task

Use time-tracking apps or digital timesheets where workers log hours by job and task. Include regular, overtime, and travel time to capture total labor cost accurately.

Step 4: Record Material and Equipment Usage

Materials pulled from stock or ordered directly for the job must be logged against that job. Similarly, track equipment usage (owned or rented) and assign costs accordingly.

Step 5: Allocate Overhead Where Appropriate

Decide how you’ll allocate general business costs like insurance, fuel, and utilities to projects. This could be a flat percentage of project cost or based on labor hours.

Step 6: Reconcile the Final Invoice with Actual Usage

Before invoicing the client, update your records to reflect what was actually used. Adjust for change orders, material returns, or labor overruns. Include line items for any differences using an “Over/Under” adjustment if needed.

Step 7: Run Job Cost Reports

Use reports like “Estimated vs. Actual,” “Gross Margin by Job,” and “Cost Breakdown by Phase” to analyze performance. Use the insights to improve future estimates, manage cash flow, and prioritize profitable project types.

Keys to Successful Implementation

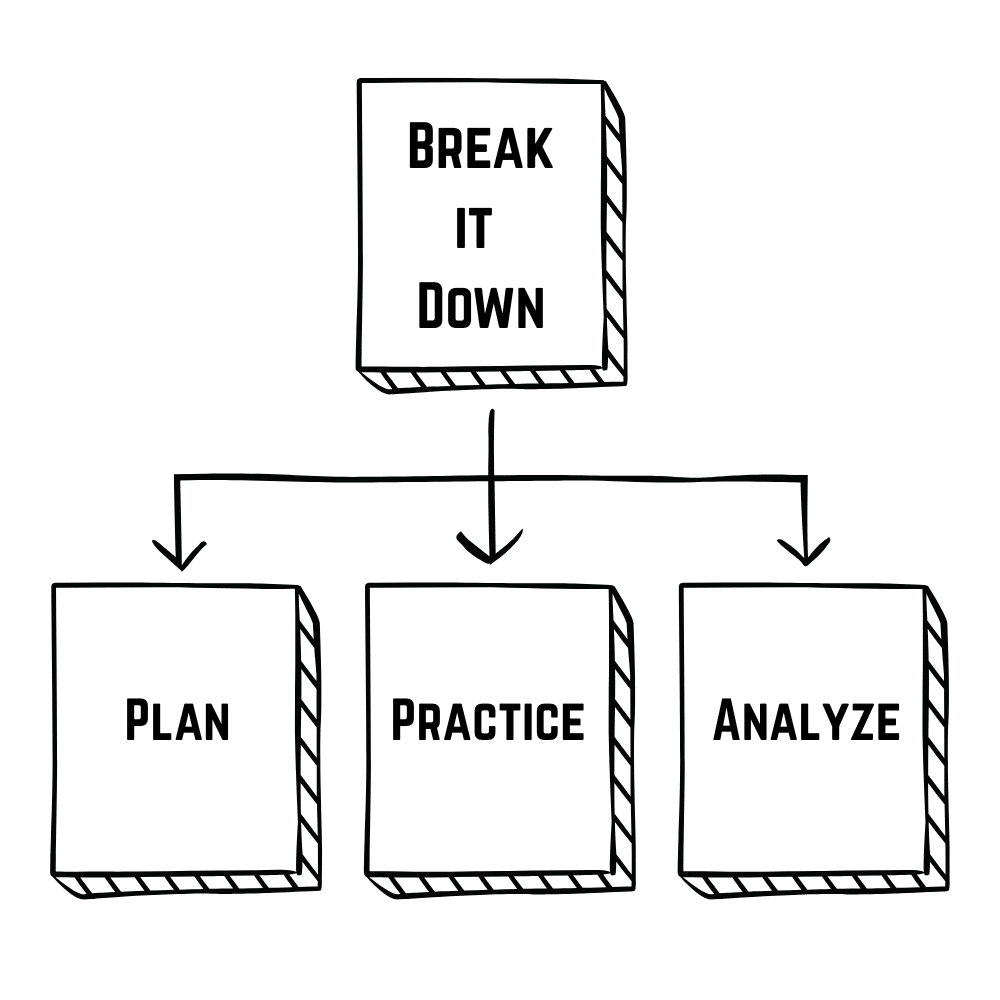

Plan: Research job costing reports that you will need and discuss what systems are currently in place. How do you currently track costs? Find out what data is important to your business and how your team will manage it.

Practice: Choose one active job to pilot your system. Get feedback from the team and troubleshoot issues before scaling up. Roll out the process across a few more projects. Review data weekly and refine your processes.

Analyze: Evaluate the reports and data quality. Are costs getting categorized correctly? Are the reports actionable? Are you getting the necessary data you listed in the plan phase?

Conclusion: Build Smarter by Tracking Every Cost

Job costing isn’t just for accountants—it’s for contractors who want to build a stronger, more profitable business. From foundation to finish, every project has hidden costs. Job costing helps you uncover them, control them, and learn from them.

Don’t let your profits get buried under poor tracking.

Frequently Asked Questions

Estimating is the process of predicting project costs before work begins, based on plans and known rates. Job costing tracks the actual costs as they occur during the project—materials, labor, equipment, and subcontractors—and compares them to the estimate. Together, they help you identify where your bids are accurate and where they need adjustment.

Even for small jobs, using unique job IDs and tracking labor and material costs per project will help you improve your pricing over time. Use digital tools to streamline this process so you don’t sacrifice accuracy for speed. Many platforms offer mobile apps where field workers can assign hours and materials to specific jobs on the go.

Look for construction-specific software that integrates job costing with estimating, time tracking, invoicing, and accounting. Options like Total Office Manager allow you to assign costs to jobs automatically and generate real-time financial reports without double entry.